Events

税務コンプライアンスで生き残りと成長 セミナー

4 Sep 2025, 03.08 WIBIdeataxと税金トーク

14 Jul 2025, 03.03 WIBWebinar Understanding Tax Reporting Based on PER-11/PJ/2025

16 Jun 2025, 07.59 WIBWebinar "Understanding the 12% VAT Policy and Dissecting PMK Number 131 of 2024"

14 Mei 2025, 02.52 WIBイデアタックス記事執筆コンテスト

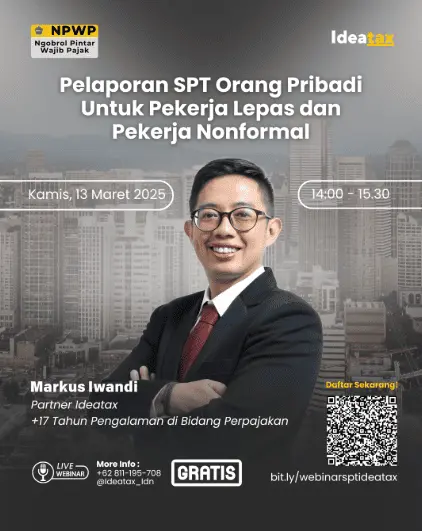

23 Okt 2024, 17.00 WIBIdeataxウェビナーフリーランス

Ideataxウェビナー: フリーランス & インフォーマルワーカーのための確定申告

年次確定申告の締め切り(2025年3月31日)が近づいています! フリーランス、ギグワーカー、または不定期収入のあるインフォーマルワーカーの方は、正しい申告方法を理解することが重要です。申告ミスや遅延を防ぎ、税務上の義務を適切に果たしましょう。

🔹本ウェビナーでは、以下の内容について解説します:

✅ フリーランス & インフォーマルワーカー向けの税務規定

✅ 正しい税額計算と確定申告の方法

✅ よくある申告ミスを防ぐための対策

✅ 税務専門家によるライブQ&Aセッション

📅 日程: 2025年3月13日(木)

⏰ 時間: 14:00 ~ 15:30(WIB)

💻 開催方法: Zoom(登録後、リンクを送付いたします)

Events

税務コンプライアンスで生き残りと成長 セミナー

4 Sep 2025, 03.08 WIBIdeataxと税金トーク

14 Jul 2025, 03.03 WIBWebinar Understanding Tax Reporting Based on PER-11/PJ/2025

16 Jun 2025, 07.59 WIBWebinar "Understanding the 12% VAT Policy and Dissecting PMK Number 131 of 2024"

14 Mei 2025, 02.52 WIBイデアタックス記事執筆コンテスト

23 Okt 2024, 17.00 WIBLatest articles

Environmental, Social, and Governance: Understanding Responsible Investment in Indonesia

The severe floods that recently hit Sumatra and Aceh are a stark reminder that environmental damage can trigger widespread social and economic consequences. Alongside heavy rainfall, illegal logging and mining practices have diminished the water...

Read Full ArticleTax Holidays in Indonesia's Special Economic Zones

The Ministry of Finance has reported a steady increase in the estimated value of tax expenditures related to tax holiday incentives in Special Economic Zones (SEZs) over the years. While the growth is modest, it reflects a rising interest and confide...

Read Full ArticlePioneer Industry Tax Incentives: Requirements and Forecasts for 2025

The 2023 tax expenditure report has been released, providing an overview of the government budget allocated for various tax incentives, including tax allowances, tax holidays, and other benefits. These incentives are designed to stimulate economic gr...

Read Full ArticleTax Revenue Realization in Q3 2025

The government has released its performance report for the state budget (APBN Kita) for November 2025. This report presents the leading macroeconomic indicators, including inflation, economic growth, commodity price movements, and state revenue perfo...

Read Full ArticleLatest Changes to the 2025 OECD Tax Treaty Model

The Organisation for Economic Co-operation and Development (OECD) has released the latest updates to the OECD Model Tax Convention on Income and Capital. This update includes detailed guidance on taxing cross-border remote work as well as new pr...

Read Full Article