Events

Pajak Kripto 101

18 Feb 2026, 09.42 WIBSPT Coretax Orang Pribadi via Coretax

18 Feb 2026, 09.36 WIBFinance & Tax Digital Transformation Forum

18 Feb 2026, 09.27 WIBTantangan SPT Era Coretax: Kepatuhan, Risiko, dan Efisiensi

18 Feb 2026, 09.15 WIBBusiness Networking Seminar: Connecting Businesses, Creating Opportunities

18 Feb 2026, 08.54 WIBWebinar Tax Return Filing

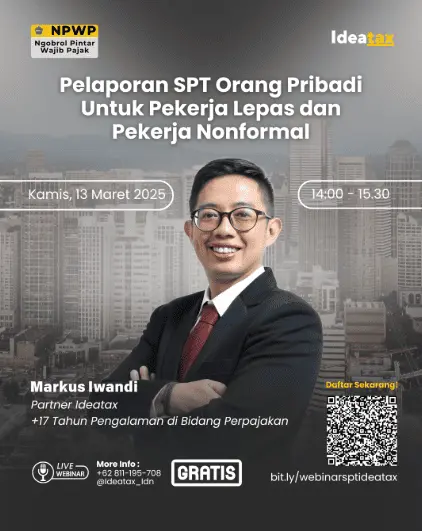

Ideatax Webinar: Individual Tax Return Filing for Freelancers & Informal Workers

The deadline for filing the annual tax return (March 31, 2025) is approaching! If you are a freelancer, gig worker, or have an informal job with irregular income, it is essential to understand the correct way to file your tax return. Avoid mistakes or delays, as they may affect your tax obligations.

In this webinar, we will discuss:

✅ Tax regulations for freelancers and informal workers

✅ How to calculate and file your tax return in compliance with regulations

✅ Solutions to avoid common tax filing mistakes

✅ A live Q&A session with a tax expert

📅 Date: Thursday, March 13, 2025

⏰ Time: 2:00 PM – 3:30 PM (WIB)

💻 Platform: Zoom (link will be sent after registration)

🔗 Registration Link:

https://forms.gle/RJRrWBKAMFhgWPg7A

Events

Pajak Kripto 101

18 Feb 2026, 09.42 WIBSPT Coretax Orang Pribadi via Coretax

18 Feb 2026, 09.36 WIBFinance & Tax Digital Transformation Forum

18 Feb 2026, 09.27 WIBTantangan SPT Era Coretax: Kepatuhan, Risiko, dan Efisiensi

18 Feb 2026, 09.15 WIBBusiness Networking Seminar: Connecting Businesses, Creating Opportunities

18 Feb 2026, 08.54 WIBLatest articles

Beneficial Ownership in Limited Liability Company Regulations

Beneficial ownership has become a cornerstone of modern corporate governance, indicating a growing emphasis on transparency regarding who ultimately controls and benefits from a legal entity. In Indonesia, this principle is reinforced by th...

Read Full ArticleTax Implications in the Establishment, Amendment, and Dissolution of Limited Liability Companies

Since its enactment in 2007, the legal framework governing limited liability companies has been amended several times. One of the most recent changes was introduced through Law of the Republic of Indonesia Number 6 of 2023, which stipulates the Gover...

Read Full ArticleCriminal Liability in VAT Compliance

In January 2026, the Minister of Finance conducted a surprise inspection of two steel companies located in the Millennium Industrial Estate, Cikupa, Tangerang, Banten. During the inspection, authorities identified indications that several Chinese-own...

Read Full ArticleThe 2026 Tax Outlook

The government has formally enacted the 2026 state budget through Law of the Republic of Indonesia Number 17 of 2025, which was jointly approved by the House of Representatives. Under the 2026 state budget law, total state revenue is set at IDR ...

Read Full ArticleTax Incentives for Mergers and Acquisitions

Source: IMAA, 2026 Mergers and acquisitions (M&A) are a widely used corporate strategy to expand operations, improve efficiency, and enhance competitiveness. According to the Institute for Mergers, Acquisitions, and Alliances (IMAA), Indones...

Read Full Article