Events

Pajak Kripto 101

18 Feb 2026, 09.42 WIBSPT Coretax Orang Pribadi via Coretax

18 Feb 2026, 09.36 WIBFinance & Tax Digital Transformation Forum

18 Feb 2026, 09.27 WIBTantangan SPT Era Coretax: Kepatuhan, Risiko, dan Efisiensi

18 Feb 2026, 09.15 WIBBusiness Networking Seminar: Connecting Businesses, Creating Opportunities

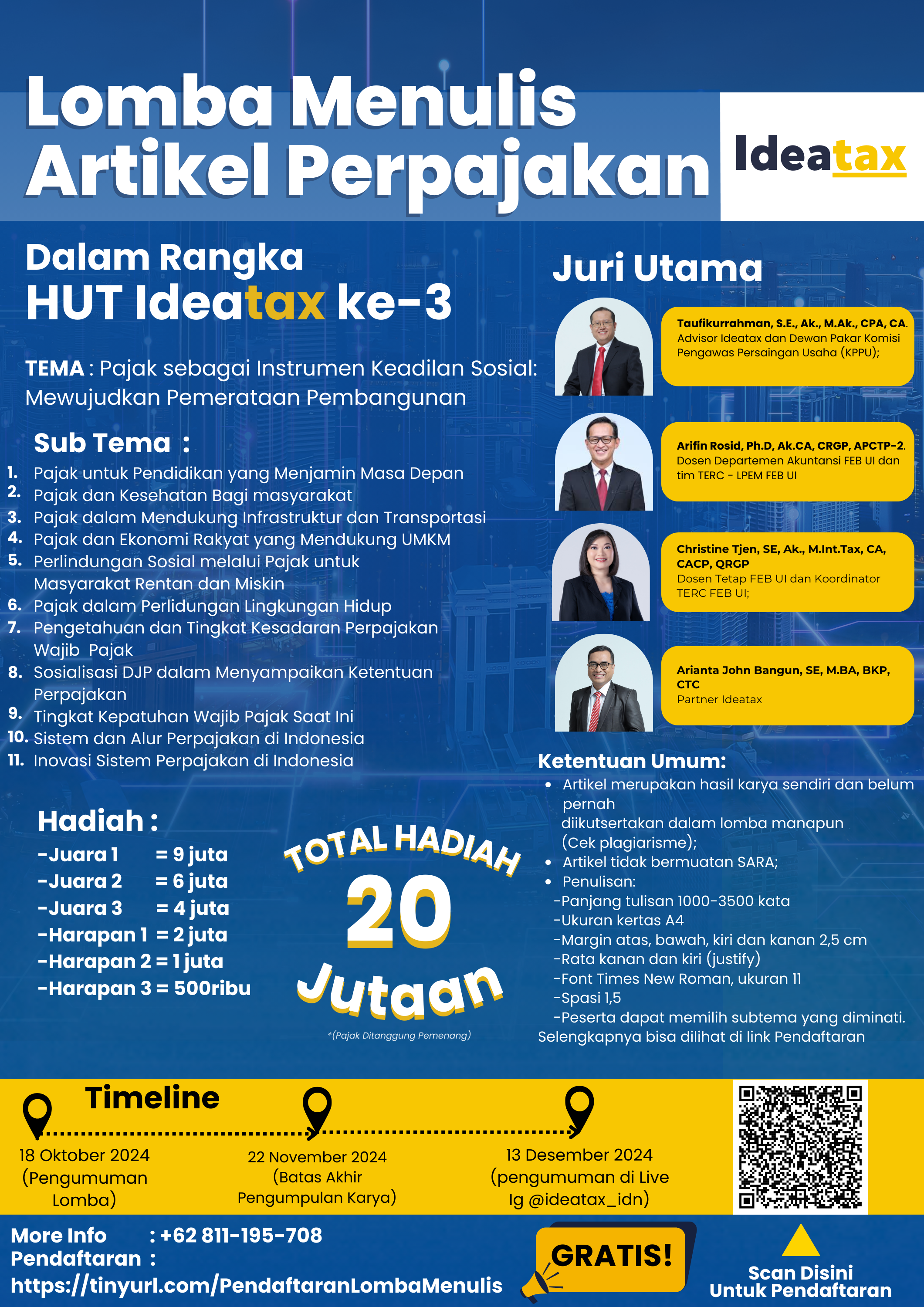

18 Feb 2026, 08.54 WIBIDEATAX ARTICLE WRITING COMPETITION

ARTICLE WRITING COMPETITION IDEATAX

A. Background

In celebration of Ideatax’s 3rd anniversary, we are organizing an Article Writing Competition to engage the public in sharing perspectives and ideas related to taxation.

This competition is part of Ideatax’s efforts to promote tax education that is more inclusive and relevant to the current digital economy. In this competition, participants will be invited to explore various topics under the theme "Tax as an Instrument of Social Justice: Achieving Equitable Development."

The competition is open to students, professionals, and the general public interested in contributing through inspiring and insightful writings. Ideatax believes that through this competition, society can actively contribute to broader and deeper discussions about the importance of taxation in Indonesia.

B. Theme

The main theme of this article writing competition is "Tax as an Instrument of Social Justice: Achieving Equitable Development." The sub-themes include:

- Tax for Education that Ensures the Future

- Tax and Healthcare for the Community

- Tax in Supporting Infrastructure and Transportation

- Tax and the People’s Economy Supporting MSMEs

- Social Protection through Tax for Vulnerable and Poor Communities

- Tax for Environmental Protection

- Knowledge and Taxpayer Awareness

- DJP's Outreach in Conveying Tax Regulations

- Current Taxpayer Compliance Level

- Tax System and Workflow in Indonesia

- Innovations in Indonesia’s Tax System

C. Timeline

| No | Agenda | Date | Organizer |

|---|---|---|---|

| 1 | Announcement of Competition | October 18, 2024 | Committee |

| 2 | Submission Deadline | November 22, 2024 | Committee |

| 3 | Judging Stage 1 (Content and PUEBI accuracy) | November 25–27, 2024 | Committee |

| 4 | Judging Stage 2 (Number of likes and shares on LinkedIn) | November 28 – December 1, 2024 | Committee |

| 5 | Judging Stage 3 (Title and content relevance to the theme) | December 2–3, 2024 | Ideatax Partner (Arianta John Bangun) |

| 6 | Judging Stage 4 (Originality and Creativity of Ideas) | December 4–12, 2024 | Main Judges |

| 7 | Competition Results Announcement | December 13, 2024 | Committee |

D. Rules

- Articles must be original and have not been submitted to any other competition (Plagiarism check will be done).

- Articles must not contain offensive content (related to ethnicity, religion, race, or societal groups).

- Articles must be written in .doc or .docx format.

- Participants can choose the sub-theme they are interested in

- Participants must fill out the registration form provided by the committee.

- Citations and sources must be written clearly.

- The publishing rights to the article will belong to Idetax, and participants will not have the authority to withdraw their article once it's been published on the Idetax website;

- Judges will conduct an initial review to assess the article's eligibility. If approved, the article will automatically enter the competition and be published on the Idetax website and LinkedIn page;

- The number of likes and shares the article receives on the Idetax website and LinkedIn will factor into the evaluation;

- All decisions made by the judges are final and cannot be appealed.

- Writing Guidelines:

- Length: 1000 - 3500 words

- Paper size: A4

- Margins: 2.5 cm on all sides

- Justified alignment

- Font: Times New Roman, size 11

- Line spacing: 1.5

E. Prizes

Total prize: Rp 22,500,000

- 1st Place = Rp 9,000,000

- 2nd Place = Rp 6,000,000

- 3rd Place = Rp 4,000,000

- Consolation Prize 1 = Rp 2,000,000

- Consolation Prize 2 = Rp 1,000,000

- Consolation Prize 3 = Rp 500,000

F. Evaluation Criteria

- Content presentation and PUEBI accuracy: 20%

- Title and content relevance to the theme: 30%

- Originality and creativity of ideas: 50%

- Number of likes/comments/shares on LinkedIn and the website.

G. Main Judges

- Taufikurrahman, S.E., Ak., M.Ak., CPA, CA – Advisor of Ideatax and Expert Board of the Indonesia Competition Commission (KPPU)

- Arifin Rosid, Ph.D., Ak.CA, CRGP, APCTP-2 – Lecturer at the Department of Accounting FEB UI and Member of TERC - LPEM FEB UI

- Christine Tjen, SE, Ak., M.Int.Tax, CA, CACP, QGRP – Permanent Lecturer at FEB UI and Coordinator of TERC FEB UI

Events

Pajak Kripto 101

18 Feb 2026, 09.42 WIBSPT Coretax Orang Pribadi via Coretax

18 Feb 2026, 09.36 WIBFinance & Tax Digital Transformation Forum

18 Feb 2026, 09.27 WIBTantangan SPT Era Coretax: Kepatuhan, Risiko, dan Efisiensi

18 Feb 2026, 09.15 WIBBusiness Networking Seminar: Connecting Businesses, Creating Opportunities

18 Feb 2026, 08.54 WIBLatest articles

Mitigating the Risk of Share Freezes

At a press conference in Jakarta on February 23, 2026, the Director General of Taxes announced that the Directorate General of Taxes (DGT) had frozen the shares of two taxpayers, valued at IDR 2.6 billion. However, the enforcement process could not p...

Read Full ArticleThe Agreement on Reciprocal Trade and Its Implications

In February 2026, the President of the Republic of Indonesia paid an official visit to the United States to attend a series of strategic meetings. A major item on the agenda was economic cooperation, culminating in the signing of the Agreement on Rec...

Read Full ArticleBeneficial Ownership in Limited Liability Company Regulations

Beneficial ownership has become a cornerstone of modern corporate governance, indicating a growing emphasis on transparency regarding who ultimately controls and benefits from a legal entity. In Indonesia, this principle is reinforced by th...

Read Full ArticleTax Implications in the Establishment, Amendment, and Dissolution of Limited Liability Companies

Since its enactment in 2007, the legal framework governing limited liability companies has been amended several times. One of the most recent changes was introduced through Law of the Republic of Indonesia Number 6 of 2023, which stipulates the Gover...

Read Full ArticleCriminal Liability in VAT Compliance

In January 2026, the Minister of Finance conducted a surprise inspection of two steel companies located in the Millennium Industrial Estate, Cikupa, Tangerang, Banten. During the inspection, authorities identified indications that several Chinese-own...

Read Full Article