Did Your Company Receive a Request for Explanation of Data and/or Information Notice (SP2DK)?

Don't worry, Ideatax is here to help!

Book a ConsultationWhat is SP2DK?

SP2DK stands for Surat Permintaan Penjelasan atas Data dan/atau Keterangan, which means a Request for Explanation of Data and/or Information Notice. SP2DK is a notice from the Directorate General of Taxes (DGT) asking taxpayers to clarify any mismatch between the reported data and the data available to the DGT.

What Triggers an SP2DK?

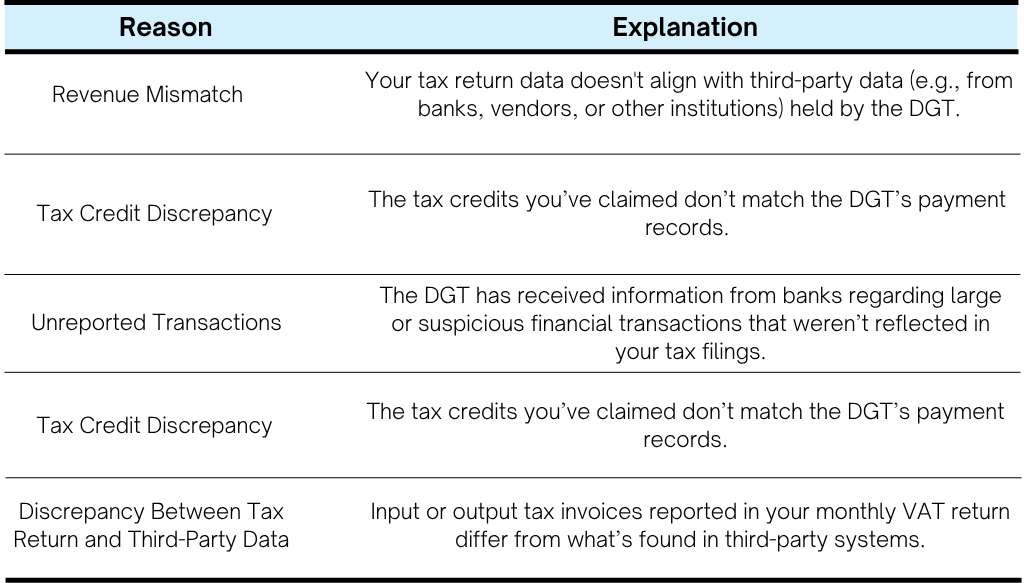

SP2DK is issued by the DGT when discrepancies arise between a taxpayer's filings and the data available to the DGT. Here are common reasons you might receive an SP2DK:

and several other possible reasons...

Responding to an SP2DK from the tax authority can be challenging for taxpayers. Unfamiliarity with the procedures or requested data often makes the process feel overwhelming.

That’s why we offer SP2DK assistance service to provide professional support to guide you through it, minimize your risk of penalties, and help your tax compliance stay intact.

How Ideatax

Can Help

Review Your SP2DK

We examine the content of your SP2DK and identify which tax type and fiscal year are disputed.

Reconcile Your Tax Data

Assist in preparing formal responses from initial findings to the issuance of the SPHP.

Draft Your Response

We highlight the main issues to address, prepare a proper written explanation, and compile the necessary supporting documents.

Submit and Follow Up

We assist in preparing a complete and timely response within the 14-day deadline set by the DGT.

Why Choose Ideatax for Tax Solutions?

01

20+ Years of Experience in Taxation

Ideatax partners bring over 20 years of experience in taxation. Our partners have worked at the Big 4 consulting firms and within the Indonesian tax authority, enabling us to deliver comprehensive and well-rounded tax solutions.

02

Trusted by Local and Foreign Investors

Ideatax is a trusted advisor in both foreign and domestic investment. We have extensive experience handling tax matters for PMA (foreign capital investment) and PMDN (domestic capital investment) companies.

03

Client-Centric Approach

We prioritize open communication and prompt responses to foster successful collaboration. We are committed to providing full support while maintaining strict confidentiality as our core value.

Ideatax Has a Proven Track Record in Resolving Tax Matters

0 +

Projects

0 +

Clients

Across Various Industries

Mining and Quarrying

Manufacturing

Business Activities

Agricultural, Forestry, and Fishery

Electricity and Gas

Hospitality

Legal Services

Construction

Insurance and Financial Services

Transportation and Warehousing

Information and Communication Technology

Retail and Wholesale

Motor Vehicle Repair

Private

Other Services