Latest Articles

Please select category

The Agreement on Reciprocal Trade and Its Implications

In February 2026, the President of the Republic of Indonesia paid an official visit to the United States to attend a series of strategic meetings. A major item on the agenda was economic cooperation, culminating in the signing of the Agreement on Rec...

Read Full Article

Beneficial Ownership in Limited Liability Company Regulations

Beneficial ownership has become a cornerstone of modern corporate governance, indicating a growing emphasis on transparency regarding who ultimately controls and benefits from a legal entity. In Indonesia, this principle is reinforced by th...

Read Full Article

Tax Implications in the Establishment, Amendment, and Dissolution of Limited Liability Companies

Since its enactment in 2007, the legal framework governing limited liability companies has been amended several times. One of the most recent changes was introduced through Law of the Republic of Indonesia Number 6 of 2023, which stipulates the Gover...

Read Full Article

Criminal Liability in VAT Compliance

In January 2026, the Minister of Finance conducted a surprise inspection of two steel companies located in the Millennium Industrial Estate, Cikupa, Tangerang, Banten. During the inspection, authorities identified indications that several Chinese-own...

Read Full Article

The 2026 Tax Outlook

The government has formally enacted the 2026 state budget through Law of the Republic of Indonesia Number 17 of 2025, which was jointly approved by the House of Representatives. Under the 2026 state budget law, total state revenue is set at IDR ...

Read Full Article

Tax Incentives for Mergers and Acquisitions

Source: IMAA, 2026 Mergers and acquisitions (M&A) are a widely used corporate strategy to expand operations, improve efficiency, and enhance competitiveness. According to the Institute for Mergers, Acquisitions, and Alliances (IMAA), Indones...

Read Full Article

Tax Brief: Fourth Amendment to Coretax Provisions

Tax provisions governing the implementation of Coretax have once again been amended. The government has officially issued Minister of Finance Regulation (Peraturan Menteri Keuangan/PMK) Number 1 of 2026 concerning the Fourth Amendment to PMK Number 8...

Read Full Article

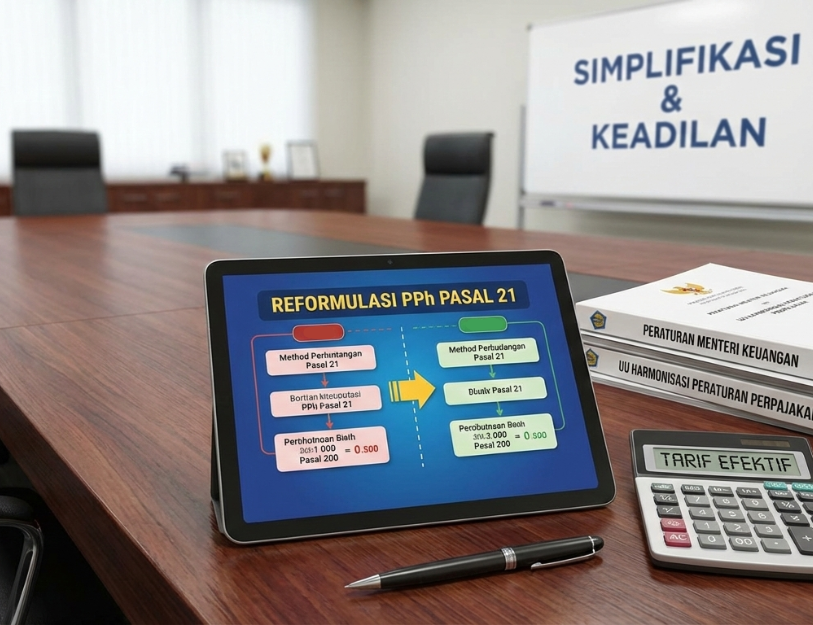

Reformulating Article 21 Withholding Tax

As of now, 186 out of 416 regencies and cities have set their 2026 regency minimum wages (upah minimum kabupaten/UMK). According to the Ministry of Manpower's preliminary recap, the average UMK for 2026 stands at IDR 3.4 million per month. The highes...

Read Full Article

Article 21 Withholding Tax Incentives for 2026

The government anticipates that 2026 will remain a challenging year marked by heightened uncertainty. Ongoing geopolitical tensions, domestic security concerns, and Indonesia’s exposure to natural disasters continue to weigh on economic growth. ...

Read Full Article